Banking and Insurance Analytics That Makes Risk and Reporting Clear

Cadeon helps banks and insurers connect data across teams so reporting is faster and decisions are backed by facts. Get stronger visibility for risk, customer trends, operations, and compliance without messy manual work.

Risk and Compliance Reporting

Build consistent reporting for audits, regulatory needs, and internal controls with traceable KPI logic.

Customer and Portfolio Analytics

Track customer trends, product performance, and portfolio movement using unified data across platforms.

Fraud and Anomaly Monitoring

Spot unusual patterns earlier using rule-based signals and trend monitoring tied to real transaction context.

Operational Performance Dashboards

Monitor turnaround time, claims or case flow, service performance, and cost metrics in one view.

Numbers That Improve When Reporting Gets Consistent

Less manual data gathering and fewer last-minute fixes before submission deadlines.

Standard KPI definitions reduce mismatched numbers across teams and tools.

Trend monitoring surfaces anomalies earlier for faster review and action.

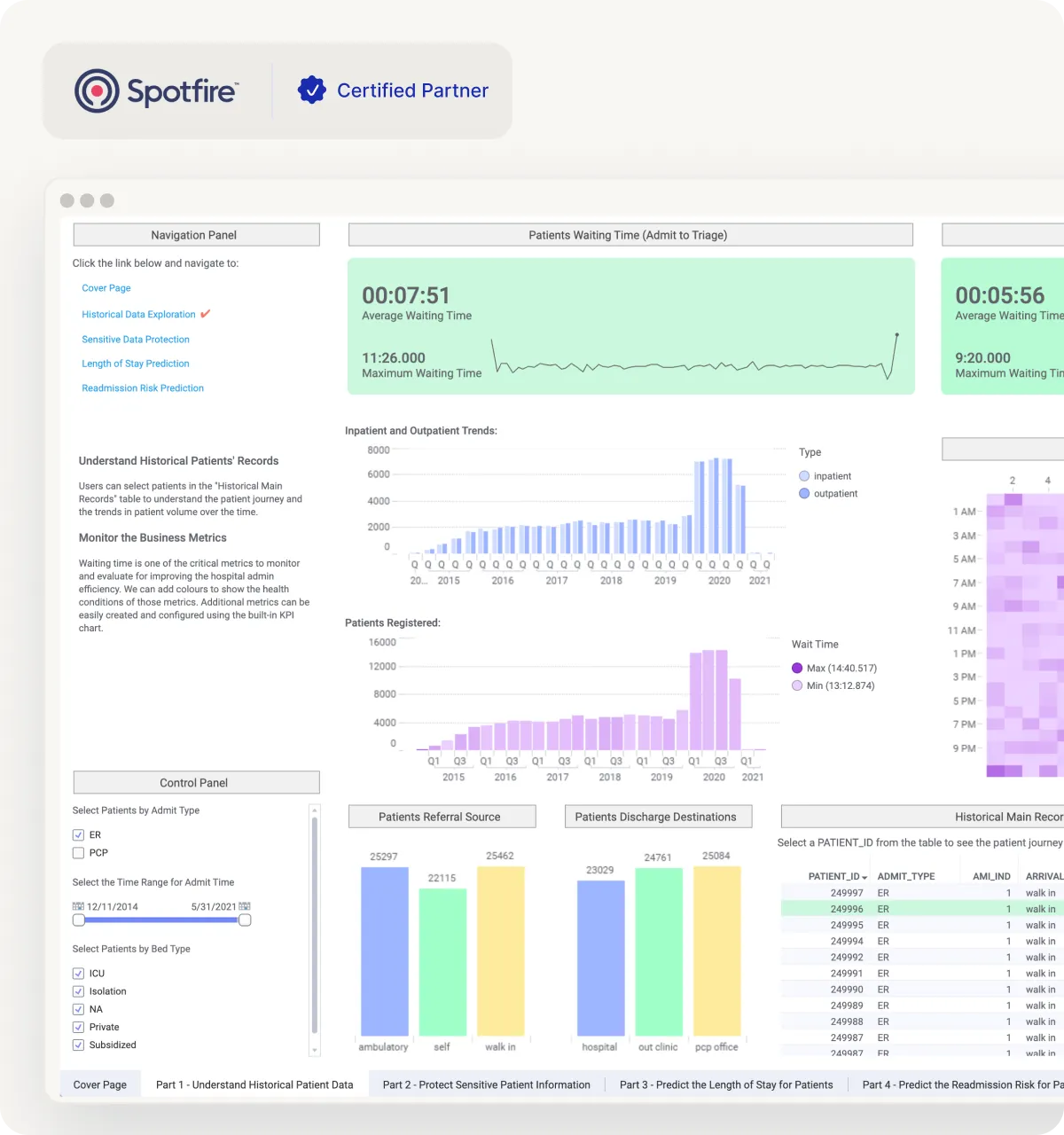

Built for regulated reporting

Reporting logic is documented and consistent, so teams can explain numbers without scrambling.

Strong cross-system integration

Core platforms, CRM, finance tools, and warehouses get connected so data stops living in silos.

Analytics that fits real workflows

Dashboards are structured for monitoring, reviews, and reporting cycles, not just visuals.

Support that stays involved

Ongoing help for KPI changes, new views, and system updates as requirements shift.

Staying Accurate After Go-Live

Banking and insurance data changes constantly. We keep your reporting clean so teams don’t lose time fixing issues.

Data monitoring

Quick checks on loads and refresh cycles to catch gaps early.

Analytics that fits real workflows

Dashboards are structured for monitoring, reviews, and reporting cycles, not just visuals.

Add new views fast

Launch a new dashboard or segment without rebuilding the full setup.

Different Systems, Different Numbers

We align KPIs and build one reporting layer so the same metric shows the same value everywhere.

Slow Reporting Cycles and Manual Reconciliation

We automate refresh cycles and standardize logic so reporting becomes routine, not a monthly emergency.

Ready for Reporting Your Teams Can Trust?

Let’s connect your systems, standardize your KPIs, and build dashboards that support risk, compliance, and performance without the manual grind.